kdexpo.ru

Market

Pay Metro Bill For Someone Else

You can pay someone else's Metro PCS phone bill through CellPay by entering the recipient's phone number and the payment amount, and complete the transaction. Add a biller account to Google Pay · Edit bill payment subscriptions · Pay a bill · View your bills · Check the status of your payment · Find your biller · Raise a. Yes, you can. You go to their website and select “Payment” at the top of the screen. You only need to enter the phone number (twice for. Applications for new EasyPay MetroCards are no longer available, and pay-per-ride EasyPay MetroCards are no longer usable to pay a transit fare. Unlimited. order it online. Trying to charge me $ for the phone and $ to activate it lol go play someone elseread more · See all reviews. METRO PCS. 2. METRO PCS. Electricity rates; Security deposits; Paying your bill; Late payments and disconnections; Closing your account; Meter reading; Equipment on your property. If nothing works out you can pay in person but their is a fee in addition to your service plan charge. Any Metro store will take the payment. For most services, regular fare: $; discounted fare: 60 cents. Various ways to pay. Multiple places to obtain fare cards or ride tickets. Learn more. A2A Yes! Naturally you can pay anyone's bill you want to. So if you choose online great. You can also pay my bills too if you like. You can pay someone else's Metro PCS phone bill through CellPay by entering the recipient's phone number and the payment amount, and complete the transaction. Add a biller account to Google Pay · Edit bill payment subscriptions · Pay a bill · View your bills · Check the status of your payment · Find your biller · Raise a. Yes, you can. You go to their website and select “Payment” at the top of the screen. You only need to enter the phone number (twice for. Applications for new EasyPay MetroCards are no longer available, and pay-per-ride EasyPay MetroCards are no longer usable to pay a transit fare. Unlimited. order it online. Trying to charge me $ for the phone and $ to activate it lol go play someone elseread more · See all reviews. METRO PCS. 2. METRO PCS. Electricity rates; Security deposits; Paying your bill; Late payments and disconnections; Closing your account; Meter reading; Equipment on your property. If nothing works out you can pay in person but their is a fee in addition to your service plan charge. Any Metro store will take the payment. For most services, regular fare: $; discounted fare: 60 cents. Various ways to pay. Multiple places to obtain fare cards or ride tickets. Learn more. A2A Yes! Naturally you can pay anyone's bill you want to. So if you choose online great. You can also pay my bills too if you like.

Using Transit GO Ticket. When you're ready to board, simply activate the ticket in your app and board the Metro bus. If boarding through the front door. Select 'account' and then 'manage payments'. From there, you can remove, add or update any credit cards on file. Please note if you are on auto-pay you do. The Metrolink App Connects with Metro Rail. Transfer to Metro. Look for the You MUST pay the one-way cash fare if your device is not working, so. What do I need to make a payment? · Biller's name & account number · Your payment amount · Bring cash or your debit card. Can I pay a bill for someone else as a guest payment? Yes! Absolutely and it is just as easy as paying your own account. Enter the recipients phone number. to find a better Company others on my page don't have to pay their bill. 4 yrs. 1. Serenity Hansberry. Metro so trash for this smh. 4 yrs. So if this info helps you – share a link to this page somewhere online to help others. It's pretty cool paying once per year for my phone bill. Why is Metro. Online one-time payment · Paying as a guest without logging in, or make a guest payment for someone else. · Paying online from your T-Mobile account. · Get your. Basically, they want to make sure it isn't someone else/another insurance company's job to pay for your care. kdexpo.ru so we can set up a payment plan. Pre-authorized Payment Plan · Telephone or online banking · At your bank or credit union · Credit card · Mail or drop box · Take care of someone else's account. Pay your T-Mobile bill as a guest, no log in required. Just enter the phone number of the account to quickly pay and be on your way. Welcome! What's going on with your MetroPCS payment? Phone still off Payment errorOthers. Online Bill Pay Online Bill Pay allows customers to view a wide range of account information online, including current balance, bill image for last For most services, regular fare: $; discounted fare: 60 cents. Various ways to pay. Multiple places to obtain fare cards or ride tickets. Learn more. How to help an elderly family member or dependent manage their natural gas and/or electricity bills and payments. Just curious, what happens to your phone number if the bill isn't paid, can they take it and give it to someone else? Upvote 1. Downvote. payment towards your Metronet bill, in the amount designated. This authorization will remain in effect unless and until the deduction is accepted and posted. with Credit/Debit, Paypal, Google Pay or Apple Pay. Learn more METRO Q Mobile Ticketing application to you or anyone else. All text. payment towards your Metronet bill, in the amount designated. This authorization will remain in effect unless and until the deduction is accepted and posted. 10 points per Bill Pay in Metro iBanking (Monthly minimum 4 transactions, maximum 10 transactions) Can I give my Metro Rewards Points to someone else?

Is This The Best Time To Purchase A Home

March is generally a good time to buy a house when the days start to get longer and the weather starts to get warmer. Many homeowners who want to sell fast are. In June , the median asking rent was $ higher than what it was at the same time in The news for renters wasn't all bad, though, because June data. Spring may not have the best weather, but it historically has the quickest home sales. One of the reasons sales inventory tends to increase when temperatures. Learn about government programs that make it easier to buy a home, including loans, mortgage assistance, and vouchers for first-time home buyers. If you're looking to choose from a large selection of homes, April may be the best month to buy a home as many sellers add new listings at the start of spring. So, if you're paying $ per month on a new vehicle, lenders will use that payment to calculate how the liability will affect your ability to purchase a home. These numbers show the cheapest time to buy a house in Florida is fall or winter. Florida home sale prices peak in late spring before dipping again in late. What to do when you've found the home you would like to purchase. Complete time of application or "let it float". Consumers choosing to lock the. Choose the right time of year · January is the best time to make an offer on a home. Not many buyers want to brave the cold to shop for a home, so prices are. March is generally a good time to buy a house when the days start to get longer and the weather starts to get warmer. Many homeowners who want to sell fast are. In June , the median asking rent was $ higher than what it was at the same time in The news for renters wasn't all bad, though, because June data. Spring may not have the best weather, but it historically has the quickest home sales. One of the reasons sales inventory tends to increase when temperatures. Learn about government programs that make it easier to buy a home, including loans, mortgage assistance, and vouchers for first-time home buyers. If you're looking to choose from a large selection of homes, April may be the best month to buy a home as many sellers add new listings at the start of spring. So, if you're paying $ per month on a new vehicle, lenders will use that payment to calculate how the liability will affect your ability to purchase a home. These numbers show the cheapest time to buy a house in Florida is fall or winter. Florida home sale prices peak in late spring before dipping again in late. What to do when you've found the home you would like to purchase. Complete time of application or "let it float". Consumers choosing to lock the. Choose the right time of year · January is the best time to make an offer on a home. Not many buyers want to brave the cold to shop for a home, so prices are.

Although buying a house for the first time is a big decision, it turns out Sometimes putting off home purchase can be a good thing, too. When you. This will give you time to get pre-approved for a mortgage and look at potential homes. home-buying-checklist. 5 to 6 Months Out. At this time, you should. For example, if you and your spouse make a combined $10, per month before taxes, it's best to keep monthly payments for your mortgage, auto loan, credit card. Typically, you will have a month or more between the time you sign a contract and the day you close on your new home. Do you need to have homeowners insurance. Best time of the year to buy a house. Housing inventory is plentiful during spring and summer, but you may pay top dollar. In general, home prices go lower. The best time to buy a house ends up being in the late summer or early fall. There tends to be less competition than at the peak during the spring and summer. AFTER A SURGE IN DEMAND FOR SECOND HOMES during the pandemic, the market for the perfect vacation home or investment property has cooled off considerably. So when is a good time to buy a house? With so much uncertainty, it can be tricky to work out whether or not to buy a house. MoneySavingExpert's Martin Lewis. Although buying a house for the first time is a big decision, it turns out Sometimes putting off home purchase can be a good thing, too. When you. You may be surprised to find the right home when and where you least expect it. Make an offer. Bring your pre-approval letter (or a copy) when you shop for a. A good reason to buy is to want a home to call your own because you're in the right place personally and financially. Without a doubt, homeownership might offer. A good reason to buy is to want a home to call your own because you're in the right place personally and financially. Without a doubt, homeownership might offer. Key takeways If finding a house for a low listing price is your priority, the best time to buy a house in New York is January. In recent years, prices for. If you're new to home buying, it's natural to wonder how the home-buying process works. From finding the perfect one to financing a home purchase, you may feel. Key Takeaways: · While monitoring if home values are rising or falling are important metrics, the best time to buy a house is when you can afford it. Sellers do tend to lower their price points in Autumn and Winter. However, if you are able to choose in which season or market you wish to buy, then use your. Sellers do tend to lower their price points in Autumn and Winter. However, if you are able to choose in which season or market you wish to buy, then use your. home the entire time. Twenty years – If you earn above the percent What's the best place to buy a new home in SC? That depends. Are you raising. Buy now vs wait mortgage calculator shows renters and first-time homebuyers why it could make sense to invest in a home now or wait to save a down payment. So, buy when you can at the current great rates. My first home was at % adjustable. It seemed terrible, but I bought to fit the budget. It.

Stock Broker Software

amibroker · Upgrade your trading to the next level · All the information at your fingertips · Powerful tools for the system trader · Concise and fast formula. Ninja Trader Review. Another big player in the game for stock analysis is NinjaTrader. This software offers traders customized options and third-party. Alpaca's easy to use APIs allow developers and businesses to trade algorithms, build apps and embed investing into their services. Specifically designed for day traders, MetaStock R/T powered by XENITH is among the world's more powerful private trader platforms. Highly customizable. Our versatile platform is fully integrated with market data & connectivity, making it the logical choice for forward-thinking agency brokers & market. List of 20 Best Stock Brokerage Software · HyperStock · MProfit · RetailGraph Software · SpeedBot · Firstrade · HyperSoft PMS · SAG. Open-Source Brokerage Exchange Platform (OpenBroker) is a cost-effective solution to deploy a market-ready online brokerage cloud platform-as-a-service (PaaS). Development. This is the most important custom trading software development aspect. At this stage, your project manager and team of developers or the trading. ProRealTime's high quality charts, analytic tools and reliable market data received directly from the exchanges make it a powerful decision support tool. amibroker · Upgrade your trading to the next level · All the information at your fingertips · Powerful tools for the system trader · Concise and fast formula. Ninja Trader Review. Another big player in the game for stock analysis is NinjaTrader. This software offers traders customized options and third-party. Alpaca's easy to use APIs allow developers and businesses to trade algorithms, build apps and embed investing into their services. Specifically designed for day traders, MetaStock R/T powered by XENITH is among the world's more powerful private trader platforms. Highly customizable. Our versatile platform is fully integrated with market data & connectivity, making it the logical choice for forward-thinking agency brokers & market. List of 20 Best Stock Brokerage Software · HyperStock · MProfit · RetailGraph Software · SpeedBot · Firstrade · HyperSoft PMS · SAG. Open-Source Brokerage Exchange Platform (OpenBroker) is a cost-effective solution to deploy a market-ready online brokerage cloud platform-as-a-service (PaaS). Development. This is the most important custom trading software development aspect. At this stage, your project manager and team of developers or the trading. ProRealTime's high quality charts, analytic tools and reliable market data received directly from the exchanges make it a powerful decision support tool.

Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. ICE Trading Platform It is all in one trading platform for any asset class that you want to trade. The UI is very user friendly and easy to learn and operate. Get the best deals on Stock Trading Software and find everything you'll need to improve your home office setup at kdexpo.ru Fast & Free shipping on many. Itransition developed TradeSmith's flagship product, a stock trading-oriented suite of web, desktop and mobile applications powered by AI algorithms. The. TC award-winning software for small investors. Super-fast and easy way to chart, filter and generate trading ideas for stocks and options. Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds. List of 20 Best Stock Brokerage Software · HyperStock · MProfit · RetailGraph Software · SpeedBot · Firstrade · HyperSoft PMS · SAG. Some trading platforms allow traders to purchase third-party software that enhances the performance of the platform provided by the brokerage firm. Key features. No-holds-barred trading experience. The flagship of the platform suite, this fully customizable software provides access to elite trading tools that give you. Thousands of Beginner and Advanced Traders. Abandon Their Old Trading Tools. For StocksToTrade forget all the old websites, software, and apps you used. Tradestation and Fidelity. The Tradestation app is pretty good, significantly better than Fidelity's. A Unified Platform. All-Inclusive suite for investing, brokerage, custody and post-trade processing. Trading on mobile device. Trading. NinjaTrader offers exclusive software for futures trading. With our modern trading platform, you will control every step of your trading journey. Below we will dig into our favorite day trading software, why we use them and why we think they are crucial for traders to have! An electronic trading platform also known as an online trading platform, is a computer software program that can be used to place orders for financial products. Focused on providing comprehensive trading and brokerage solutions, this online market access software features a backlog of historical data in addition to real. Tradesmarter White Label Trading Platform provides an all-in-one proprietary trading platform including client's cabinet & back-office software. An electronic trading platform also known as an online trading platform, is a computer software program that can be used to place orders for financial products. Elevate your trading & investing with TrendSpider: the all-in-one platform for real-time data, time-saving automation & sophisticated market research. After hundreds of hours of reviewing over 47 stock brokers (we look at commissions, fees, account types, customer service, and more) our experts came up with.

Apple Card 3 Merchants 2021

Apple Watch paired with an iPhone, or Series 3 or newer with cellular; On Apple Cash card at more merchants. Alternatively, the user can choose to. Also, some cards partner with specific merchants to give the cardholder an Week of 3/1/ Market Recap. March 7, Apple Card is a credit card created by Apple Inc. and issued by Goldman Sachs, designed primarily to be used with Apple Pay on an Apple device. Albert Salerno. IT Support & Management | Over 25 Years Published Dec 3, + Follow. The Apple Life: As many of my friends and colleges know I am a. Apply to see your credit limit offer. Get up to 3% Daily Cash on every purchase. Pay no fees. 1 And automatically grow Daily Cash over time in a high-yield. Apple Card, stylized as Card, is a credit card created by Apple Inc. and issued by Goldman Sachs, designed primarily to be used with Apple Pay on Apple. May 28, — 3 min read. Employee Handbooks – How to Write One and What to With Square Debit Card, a personalized business debit card, you can use Apple. merchant. Apple-Card_iPhoneXS-Total-Balance_ Features of Apple Card Apple products and services, they will get 3% Daily Cash. © Copyright It is a physical and a digital card - unlike Apple Cash, a digital-only prepaid card. Apple Card sits in Apple Wallet and can be used at Apple Pay locations. Apple Watch paired with an iPhone, or Series 3 or newer with cellular; On Apple Cash card at more merchants. Alternatively, the user can choose to. Also, some cards partner with specific merchants to give the cardholder an Week of 3/1/ Market Recap. March 7, Apple Card is a credit card created by Apple Inc. and issued by Goldman Sachs, designed primarily to be used with Apple Pay on an Apple device. Albert Salerno. IT Support & Management | Over 25 Years Published Dec 3, + Follow. The Apple Life: As many of my friends and colleges know I am a. Apply to see your credit limit offer. Get up to 3% Daily Cash on every purchase. Pay no fees. 1 And automatically grow Daily Cash over time in a high-yield. Apple Card, stylized as Card, is a credit card created by Apple Inc. and issued by Goldman Sachs, designed primarily to be used with Apple Pay on Apple. May 28, — 3 min read. Employee Handbooks – How to Write One and What to With Square Debit Card, a personalized business debit card, you can use Apple. merchant. Apple-Card_iPhoneXS-Total-Balance_ Features of Apple Card Apple products and services, they will get 3% Daily Cash. © Copyright It is a physical and a digital card - unlike Apple Cash, a digital-only prepaid card. Apple Card sits in Apple Wallet and can be used at Apple Pay locations.

Apple built partnerships with major banks, credit card issuers, and payment processors to integrate payment systems with Apple Pay. Apple Pay generates revenue. As per Apple, Apple Card gives you unlimited 3% Daily Cashback on everything you buy at Apple — whether it's a new Mac, an iPhone case. And when you use your Apple Card with Apple Pay, you get a daily cash-back of 2% (3% for some deleted merchants.). Walmart simply can't do 3% cashback with Apple Card. For merchants other than Apple, giving 3% cashback requires the use of Apple Pay to pay and. Comparative Analysis with Other Cards · Annual Fee: Apple Card does not charge an annual fee. · Reward: Get 3% Cash Back on Apple Pay Purchases at Select. The Complete List of Apple Pay Retailers ; Aeropostale; Adidas; American Eagle Outfitters; Anthropologie; Apple (of course) ; Acme Markets; Albertsons; ALDI. Discover Card does not assign MCCs to merchants. Certain third-party payment 3/31/24, on up to $1, in purchases. Restaurant purchases include. NEW YORK, NY, August 19, – Apple Card, created by Apple, is the only 3 percent Daily Cash back on purchases made directly with Apple and select merchants. 3. More importantly still, Apple is understood to have made several stipulations of Goldman at the outset of the deal which are likely to contribute to higher. , this applies on up to $, per calendar year), 5X points on Capital One Savor Cash Rewards Credit Card*: 3% cash back at grocery stores. Apple Card's usual 1%-3% Daily Cash benefits are unchanged for Apple Card Family, but now even more merchants are part of the 3% Daily Cash program. These. Merchants are required to have the relevant Payment Card Industry (PCI) Compliance capabilities to process and store card data. How it Works. The customer. Goldman has been Apple's credit card partner since the card's launch in and has expanded its collaboration to include other banking. 3 can be used with in-app purchases. Devices will need to be You can also use your card(s) while shopping in apps with Apple Pay at select merchants. The issuer uses them to determine if you get bonus rewards. Updated May 31, p.m. PDT · 3 min read. Profile photo of Robin Saks Frankel. Can anyone ELI5 how Apple & Google Pay work in detail? I used to think they simply pass on my CC details to the merchant or the merchant's chosen payment. August 19, PM. My only complaint with the I've contacted Apple/GS and they just say it's the merchant, but the merchants have no idea why it's. Plus, you'll likely also benefit from fewer chargebacks. Since Apple Pay encrypts card information and doesn't transmit that information to you, the merchant. The Complete List of Apple Pay Retailers ; Aeropostale; Adidas; American Eagle Outfitters; Anthropologie; Apple (of course) ; Acme Markets; Albertsons; ALDI. For more details on 3 percent Daily Cash merchants, visit kdexpo.ru © Apple Inc. All rights reserved. Apple, the Apple Store, App Store.

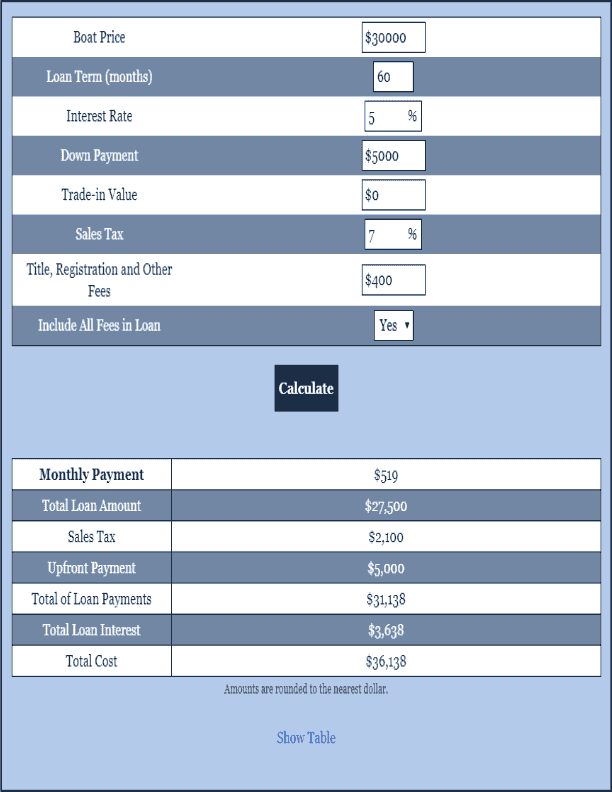

New Boat Payment Calculator

Our convenient boat financing calculator can help you predict the monthly and total cost of your next boat loan by providing the following information. Estimate your payment. Select your boat. Boat series: 19 FT Boats, 22 FT Boats, 25 FT Boats, 27 FT Boats, Wake Series Boats, Center Console Boats. By using our boat loan calculator, you can estimate what your payment may be based on how much you plan to borrow, what your interest rate is, and how long. Boat Loan Calculator. Estimate your monthly payments with interest or see how much boat you can afford using your own budget. Our loan calculator will help. These tools will help you determine what monthly payment you may be able to afford when you are looking to finance a used or new boat. To use our boat loan. NC Boats is a marine dealer in New Bern & Wilmington, NC. We feature Boats Unlimited NC Finance Calculator. Calculate Payment. Use this calculator if. See what size boat you can afford with our Boat Loan Calculator. Determine your loan and monthly payments. Find a boat that fits your budget today! Texas Marine's boat loan payment calculator is a quick tool to help you assess a price range you should target for your new or used boat. Ready to buy a boat? Use Trident Funding's easy boat loan calculator to estimate your monthly payments or calculate your total loan amount. Our convenient boat financing calculator can help you predict the monthly and total cost of your next boat loan by providing the following information. Estimate your payment. Select your boat. Boat series: 19 FT Boats, 22 FT Boats, 25 FT Boats, 27 FT Boats, Wake Series Boats, Center Console Boats. By using our boat loan calculator, you can estimate what your payment may be based on how much you plan to borrow, what your interest rate is, and how long. Boat Loan Calculator. Estimate your monthly payments with interest or see how much boat you can afford using your own budget. Our loan calculator will help. These tools will help you determine what monthly payment you may be able to afford when you are looking to finance a used or new boat. To use our boat loan. NC Boats is a marine dealer in New Bern & Wilmington, NC. We feature Boats Unlimited NC Finance Calculator. Calculate Payment. Use this calculator if. See what size boat you can afford with our Boat Loan Calculator. Determine your loan and monthly payments. Find a boat that fits your budget today! Texas Marine's boat loan payment calculator is a quick tool to help you assess a price range you should target for your new or used boat. Ready to buy a boat? Use Trident Funding's easy boat loan calculator to estimate your monthly payments or calculate your total loan amount.

Check today's boat financing rates and use our calculator to see what your payment will be. We offer loans for new and used boats. Use Boatzon's boat loan calculator to determine your estimated monthly payments and your approximate rate for a new or used boat loan. calculating sales tax. In addition, Alaska, Delaware, Montana, and New Hampshire. have no sales tax on vehicles. © Lanier Federal Credit Union kdexpo.rufcu. A Consumer's Guide to Classic Boat Loans & New Yacht Financing Programs. Boat Loan Calculator. This calculator figures monthly boat loan payments. To help you. Use our new and used boat payment calculator to estimate your monthly payments, finance rates, payment schedule and more with U.S. Bank. calculating your estimated monthly payment based on the marine vehicle's You can finance a new or used boat, boat construction, international boat. Colorful, interactive, simply The Best Financial Calculators! Use this calculator to help you determine your monthly boat loan payment or your boat purchase. This online calculator can estimate the monthly payments you will need to make based on the loan amount, interest rate, and loan term you select. Estimate your boat payment. Use our boat financing calculator to estimate your rate and monthly payment for a new or used boat. Calculate your payment. Pontoon Boat Financing Calculator. Enter your information below to calculate your estimated boat payment. Utilize our boat loan calculator to estimate your. Use our boat payment calculator to determine a monthly payment that you can afford when looking to finance a new or used boat. Use this calculator to determine your monthly boat loan payment or your boat purchase price. new boat with great boat loan payments. The calculator will not ask you for sensitive data like your credit score, your previous personal loans, debt to. Use this calculator to help you determine your boat loan payment or your boat purchase price. After you have entered your current information, use the graph. Pontoon Boat Financing Calculator. Enter your information below to calculate your estimated boat payment. Utilize our boat loan calculator to estimate your. Estimating loan payments is simply a matter of basic math. Once you understand a few terms, you'll be able to easily figure out how much to budget for your new. Always consult a professional financial advisor. Use this tool to get an idea of just how affordable a new boat can be for you and your family! Actual payments. Boat Loan Calculator. in partnership with. official show sponsors LeafFilter NMMA Certified. Atlanta Boat Show New Logo. Date/Time; January , Boat Loan Calculator. Boating may be more affordable than you think. In some instances, you can buy a brand new boat Calculate Payment. *Desired Vehicle. Purchasing a new boat or jet ski is exciting! Use our handy calculator to see what your new payment might be. This calculator is for estimation purposes.

What Does Climeworks Specialize In

Climeworks' new facility in Iceland transports the CO2 filtered out of the air below the Earth's surface, where natural processes then mineralize it. The carbon. By removing carbon dioxide using direct air capture technology, Climeworks is working to achieve climate positive impact for the future of our world. 5. High-quality carbon removal company for your climate strategy. Join the world's top businesses and enable the scale-up of the carbon removal industry. High-quality carbon removal company for your climate strategy. Join the world's top businesses and enable the scale-up of the carbon removal industry. A major advantage of DAC is its flexibility in siting: in theory, a DAC plant can be situated in any location that has low-carbon energy and a CO2 storage. Our Direct Air Capture (DAC) technology does this by pulling in atmospheric air, then through a series of chemical reactions, extracts the carbon dioxide. Climeworks is a company that specializes in direct air carbon capture (DAC). Their facility, with a larger one currently under construction, in Iceland uses. Climeworks is a high-quality carbon removal company based in Zurich, offering carbon removal services for enterprises, small to medium businesses, and. Climeworks helps the world's top businesses remove CO 2 from the air. The Swiss start-up hopes to play a major role in reducing greenhouse gas emissions in. Climeworks' new facility in Iceland transports the CO2 filtered out of the air below the Earth's surface, where natural processes then mineralize it. The carbon. By removing carbon dioxide using direct air capture technology, Climeworks is working to achieve climate positive impact for the future of our world. 5. High-quality carbon removal company for your climate strategy. Join the world's top businesses and enable the scale-up of the carbon removal industry. High-quality carbon removal company for your climate strategy. Join the world's top businesses and enable the scale-up of the carbon removal industry. A major advantage of DAC is its flexibility in siting: in theory, a DAC plant can be situated in any location that has low-carbon energy and a CO2 storage. Our Direct Air Capture (DAC) technology does this by pulling in atmospheric air, then through a series of chemical reactions, extracts the carbon dioxide. Climeworks is a company that specializes in direct air carbon capture (DAC). Their facility, with a larger one currently under construction, in Iceland uses. Climeworks is a high-quality carbon removal company based in Zurich, offering carbon removal services for enterprises, small to medium businesses, and. Climeworks helps the world's top businesses remove CO 2 from the air. The Swiss start-up hopes to play a major role in reducing greenhouse gas emissions in.

Climeworks is a carbon capture company based in Switzerland. Climeworks is on a mission to reverse climate change, and it wants at least. Climeworks' technology draws in ambient air and captures the CO2 with a patented filter. The filter is then heated with low-grade heat from the geothermal plant. Climeworks helps the world's top businesses remove CO 2 from the air. The Swiss start-up hopes to play a major role in reducing greenhouse gas emissions in. The potential of scaling up our technology in combination with CO₂ storage is enormous. Not only here in Iceland but also in numerous other regions, which have. By removing carbon dioxide using direct air capture technology, Climeworks is working to achieve climate positive impact for the future of our world. 5. Climeworks engages in capturing CO2 from the air via commercial carbon dioxide removal technology. Industries: Mechanical Or Industrial Engineering. Website. Our Direct Air Capture (DAC) technology is a key climate solution. It captures CO₂ from the air by only using renewable energy. Climeworks is at base camp. They are at the beginning of an ambitious plan to be part of playing a role in reversing climate change. The company. Climeworks, founded in Zurich in by Christoph Gebald and Jan Wurzbacher, is a pioneer in the field of direct air capture technology. OCED is working with Battelle, the DAC Hub owner, and its technology providers Climeworks and Heirloom to build DAC facilities in Calcasieu and Caddo Parishes. Climeworks' new facility in Iceland transports the CO2 filtered out of the air below the Earth's surface, where natural processes then mineralize it. The carbon. A major advantage of DAC is its flexibility in siting: in theory, a DAC plant can be situated in any location that has low-carbon energy and a CO2 storage. Climeworks is the global leader in carbon removal, empowering companies to advance their net zero roadmaps and fight global warming. In March we had the. In November they founded Climeworks as a spin-off of the technical university (ETH) in Zürich. Today, the company is the world leader in direct air capture. How it works is that Carbon dioxide is trapped in the atmosphere which makes the temperature rise, which cause climate change. This device can suck in the air. It will concentrate on implementing large modular direct air capture and storage facilities, investing in technological development, and growing its. Source: Inspired by Iceland This is the reason why the Orca plant is located there, completely and solely powered by renewable energy. In fact, the heat and. Climeworks is the global leader in carbon removal, empowering companies to advance their net zero roadmaps and fight global warming. Key company information. The aim is for members to eventually be able to use their points for DAC plus permanent storage. • In , Climeworks debuted the world's first commercial. Climeworks offers a metered and permanent approach to Carbon Dioxide Removal. This makes the Climeworks solution an important opportunity for companies and.

Healthcare Home Buying Program

Home Buying GRANTS up to $8, · Down Payment Assistance up to $10, · Home loans for nurses and healthcare workers · Simple Docs Program™ · NO application. The Live Near Your Work program provides select Washington University and BJC HealthCare employees with forgivable loans to help with the purchase of a home in. It is designed to help healthcare workers purchase a home by providing them with access to special loans and down payment assistance. Who Is Eligible to Apply. Montana Board of Housing down payment assistance programs can reduce the amount of up-front cash needed to purchase a home. Home / State Information / Pennsylvania / Homeownership - Redirect / Homeownership Assistance - Redirect. The page you are looking for has been updated. You. Save Thousands When Buying a Home. Receive up to 5 percent of the first mortgage loan amount (maximum of $35,) in assistance. The Thank You Heroes Home Rebate Program was solely built to be a safe place for all medical personnel, supporting roles, and families to buy and sell homes. We are excited to announce that the Home Ownership Incentive Program has expanded and now provides a financial increase, raising the amount from $9, to. Next Door Programs is the largest National Home Buying Program in the United States, offering grants, down payment assistance, and special programs. Home Buying GRANTS up to $8, · Down Payment Assistance up to $10, · Home loans for nurses and healthcare workers · Simple Docs Program™ · NO application. The Live Near Your Work program provides select Washington University and BJC HealthCare employees with forgivable loans to help with the purchase of a home in. It is designed to help healthcare workers purchase a home by providing them with access to special loans and down payment assistance. Who Is Eligible to Apply. Montana Board of Housing down payment assistance programs can reduce the amount of up-front cash needed to purchase a home. Home / State Information / Pennsylvania / Homeownership - Redirect / Homeownership Assistance - Redirect. The page you are looking for has been updated. You. Save Thousands When Buying a Home. Receive up to 5 percent of the first mortgage loan amount (maximum of $35,) in assistance. The Thank You Heroes Home Rebate Program was solely built to be a safe place for all medical personnel, supporting roles, and families to buy and sell homes. We are excited to announce that the Home Ownership Incentive Program has expanded and now provides a financial increase, raising the amount from $9, to. Next Door Programs is the largest National Home Buying Program in the United States, offering grants, down payment assistance, and special programs.

Program targets veterans, active military and spouses. First-time homebuyer requirement is waived for this program. Maximum home sales price* up to $, HOME Plus provides an attractive year fixed-rate mortgage with a down payment assistance (DPA) grant that can be used toward the down payment and/or closing. The NJHMFA Down Payment Assistance Program (DPA) provides up to $15, for qualified first-time homebuyers to use as down payment and closing cost. Down Payment Assistance through the GSFA Platinum Program may help you to purchase a home sooner than you thought possible. Grants up to $ for nurses and healthcare workers. Plus, up to $ in down payment assistance. Special programs for nurses and healthcare employees. Borrow up to % of home's purchase price with a VA or USDA-RD loan or % with FHA loans. The Homeownership for Heroes program is available to: Active Duty. Buyers receiving loan greater than $40, must reside in the home purchased at least 15 years. Effective Date: 6/01/24; Source: HOME Purchase Price Limits for. We lower this barrier by offering downpayment assistance loans for homebuyers who use our mortgage programs (Home Advantage and House Key). ADFA Homeownership and Down Payment Assistance Programs make purchasing a home more affordable for low-to-moderate income families and individuals. Our Homes for Texas Heroes Program offers home loans and down payment assistance for teachers, first responders, corrections officers, and veterans. This program provides down payment and closing cost assistance to first-time, income-qualified homebuyers so they can purchase a primary residence. The Dallas Homebuyer Assistance Program (DHAP) provides homeownership opportunities to low- and moderate-income homebuyers through the provision of financial. The Georgia Dream Homeownership Program makes purchasing a home possible for eligible residents. Georgia Dream provides affordable financing options. MMP home loans are available as either Government or Conventional insured loans. Government loans can be guaranteed by the Federal Housing Administration (FHA). The California Dream For All Shared Appreciation Loan is a down payment assistance program for first-time homebuyers to be used in conjunction with the Dream. The City of Mobile's First Time Home Buyers' Program is a homeownership program designed to help income eligible households with down payment and closing costs. The Atlanta Housing Down Payment Assistance (DPA) Program provides down payment assistance to eligible first-time homebuyers up to $20,, subject to meeting. That's why MassHousing provides eligible homebuyers with Down Payment Assistance of up to $30, when purchasing a home in every city and town in Massachusetts. The CalHERO Home Loan and assistance program offers special financing for nurses and healthcare workers when buying or refinancing a home.

5 Year Waiting Period For Roth Conversion

Roth IRA conversions require a 5-year holding period before earnings can be withdrawn tax-free and subsequent conversions will require their own 5-year. A qualified distribution from your Roth IRA may be made after a five-year waiting period has been satisfied (this period begins January 1of the tax year of. The first five-year rule states that you must wait five years after your first contribution to a Roth IRA to withdraw your earnings tax-free. If withdrawn from subsequent Roth before end of five-year period, 10% recapture tax will apply. • A separate designated Roth sub-account should be established. This is because a five-year waiting period is required if you are under age 59 1/2 before you can distribute the converted amount without owing the 10%. Nonqualified withdrawals: If you withdraw conversion contributions before the five-year period is over, you might have to pay a 10% Roth IRA early withdrawal. All distributions must be made by the end of the 10th year after death, except for distributions made to certain eligible designated beneficiaries. See year. If you take a distribution of Roth IRA earnings before you reach age 59½ and before the account is five years old, the earnings may be subject to taxes and. As the name suggests, the five-year rule requires you to satisfy a five-year holding period before you can withdraw Roth IRA earnings tax-free or converted. Roth IRA conversions require a 5-year holding period before earnings can be withdrawn tax-free and subsequent conversions will require their own 5-year. A qualified distribution from your Roth IRA may be made after a five-year waiting period has been satisfied (this period begins January 1of the tax year of. The first five-year rule states that you must wait five years after your first contribution to a Roth IRA to withdraw your earnings tax-free. If withdrawn from subsequent Roth before end of five-year period, 10% recapture tax will apply. • A separate designated Roth sub-account should be established. This is because a five-year waiting period is required if you are under age 59 1/2 before you can distribute the converted amount without owing the 10%. Nonqualified withdrawals: If you withdraw conversion contributions before the five-year period is over, you might have to pay a 10% Roth IRA early withdrawal. All distributions must be made by the end of the 10th year after death, except for distributions made to certain eligible designated beneficiaries. See year. If you take a distribution of Roth IRA earnings before you reach age 59½ and before the account is five years old, the earnings may be subject to taxes and. As the name suggests, the five-year rule requires you to satisfy a five-year holding period before you can withdraw Roth IRA earnings tax-free or converted.

However, if you had not yet reached age 72 by December 31, , you must take your first RMD from your traditional IRA by April 1 of the year after you reached. Let's look at how these rules might cause problems in a conversion. Let's say your client is 40 years old and wants to convert her $, traditional IRA to a. *You must meet minimum qualifications to withdraw your Roth funds tax-free. These include a five-year holding period from the year of your first contribution. There is a specific nuance to the five year rule as it applies to conversions though. Each conversion has its own five year waiting period. This is different. The five-year period starts at the beginning of the calendar year that you did the conversion.8 So, for example, if you converted traditional IRA funds to a. The five-year period starts at the beginning of the calendar year that you did the conversion.8 So, for example, if you converted traditional IRA funds to a. For the 10% penalty, each conversion has its own 5-year clock. Contributions. Come out first. Always no tax & no penalty. * Earnings are. Once you satisfy the five-year requirement for a single Roth IRA, you're done. Any subsequent Roth IRA is considered held for five years. If you have a Roth These conversion amounts are distributed tax-free on a first in, first out basis. Converted amounts taken before the five-year holding period, or you are 59½ or. Let's look at how these rules might cause problems in a conversion. Let's say your client is 40 years old and wants to convert her $, traditional IRA to a. For Roth IRAs, a 5-year period must pass from the start of the tax year when you first contribute to a Roth account before you can withdraw. The converted amount can be withdrawn tax free since tax was paid on conversion. If this conversion establishes the first Roth account then a five year waiting. The converted amount can be withdrawn tax free since tax was paid on conversion. If this conversion establishes the first Roth account then a five year waiting. A: No. Each Roth conversion has a separate five-year holding period for determining whether a withdrawal of converted money is subject to a 10% federal penalty. Does the five-year rule apply to a Roth conversion? According to IRS guidelines, you must hold a Roth account for five years, and you must be at least 59 1/2. The 5-year rule on Roth conversions requires you to wait five years before withdrawing any converted balances — contributions or earnings. Because of the Roth IRA 5-year rule, you generally have to wait at least five years before withdrawing earnings tax-free from your Roth IRA. You can, however. 2 Roth withdrawals are tax-free if individual has owned a Roth IRA for a 5-year holding period and either a) is over the age of. /2; b) qualifies for a. After opening and contributing to a Roth IRA, you'll need to wait five years to begin tax-free withdrawals of investment earnings. If you're withdrawing earnings, the five-year period begins on January 1 of the tax year for which you made your first contribution to any Roth IRA. For example.

What Is The Best Fixed Rate Bond For 1 Year

Atom Bank – 5% for one year; Hampshire Trust Bank – % for two years; Hampshire Trust Bank – % for three years. Online savings platforms. £ cashback. 1 year. Balance. Standard Interest Rate. Annual Percentage Yield (APY). $0 When my Special Fixed Rate CD matures will it automatically renew into another. Compare one-year fixed rate bonds with MoneySuperMarket. We have a broad range of competitive deals so you can find the right short-term savings account for. % AER/tax free interest for the one year term. % AER/tax free for the one year term if you already have a Halifax Personal Current Account that has been. 1 year Fixed Rate Savings at % · FSCS protection up to £85, · No fees or charges · Save from £1, to £85, · UK based customer support. Looking for a fixed rate of interest and don't mind locking your money away for a while? Take a look at our Fixed Rate Bonds. Using our regularly updated chart below, you can compare the best short-term fixed rate bonds throughout the UK, including three-month, six-month and. A fixed-rate ISA is one way to use your tax-free allowance in a year. Subject to the risks noted above, if such an account is paying more than an easy-access. EE Bonds. Guaranteed to double in value in 20 years. Earn a fixed rate of interest. Current Rate: %. For EE bonds issued May 1, to October 31, Atom Bank – 5% for one year; Hampshire Trust Bank – % for two years; Hampshire Trust Bank – % for three years. Online savings platforms. £ cashback. 1 year. Balance. Standard Interest Rate. Annual Percentage Yield (APY). $0 When my Special Fixed Rate CD matures will it automatically renew into another. Compare one-year fixed rate bonds with MoneySuperMarket. We have a broad range of competitive deals so you can find the right short-term savings account for. % AER/tax free interest for the one year term. % AER/tax free for the one year term if you already have a Halifax Personal Current Account that has been. 1 year Fixed Rate Savings at % · FSCS protection up to £85, · No fees or charges · Save from £1, to £85, · UK based customer support. Looking for a fixed rate of interest and don't mind locking your money away for a while? Take a look at our Fixed Rate Bonds. Using our regularly updated chart below, you can compare the best short-term fixed rate bonds throughout the UK, including three-month, six-month and. A fixed-rate ISA is one way to use your tax-free allowance in a year. Subject to the risks noted above, if such an account is paying more than an easy-access. EE Bonds. Guaranteed to double in value in 20 years. Earn a fixed rate of interest. Current Rate: %. For EE bonds issued May 1, to October 31,

Fixed Rate Bonds. Fixed Rate eBond until 30 September Interest Rate. %. Gross per year/AER fixed. Withdrawals / Closure. You cannot make withdrawals. This means that new bonds are being issued at 7%, and the investor is no longer earning the best return on his investment as he could. Because there is an. % AER/tax free interest for the one year term. % AER/tax free for the one year term if you already have a Halifax Personal Current Account that has been. How do fixed-rate bonds work? · Choose the length of the bond term – one-year fixed-rate bonds and five-year fixed-rate bonds are among the most common terms. Right now, the best 1-year CD rate is % APY from Mountain America Credit Union and Merchants Bank of Indiana. Compare the highest 1-year CD rates. Choose an account · 1 Year Fixed Rate Bond %. - Fixed term until 14/10/; - UK residents aged 18 or over; - Open online with £; - Earn annual. Our Fixed Rate Bonds give you a guaranteed rate to grow your savings. So, you'll know how much you'll earn by the end of the fixed term. 1 Year Fixed Rate Bond. Compare fixed-rate savings bonds ; 1-Year Fixed-rate Bond. %. (£ to £1 million). From £ Open with a lump sum deposit. No further deposits allowed ; Today's new Issues offer savers % gross/AER for one-year fixed rate Guaranteed Growth Bonds and % gross/% AER for Guaranteed Income Bonds. These. Fixed Rate Bonds · 1 Year Fixed Rate Bond - Annual · Find out more. % · 2 Year Fixed Rate Bond - Annual · Find out more. % · 3 Year Fixed Rate Bond -. EE bonds, I bonds. Current interest rates. (for bonds you buy May 1, to October 31, ). % (stays same at least 20 years), %. Fixed interest rate for a full year: Once you open a CD, you lock in the But don't just open any savings account—a high-yield savings account that pays a. View and compare top 1 year fixed rate bonds ; · Mizrahi Tefahot Bank Ltd · + £2, ; · Zenith Bank UK Ltd · + £2, ; · Isbank UK · + £2, ; What is the interest rate? ; Tier. Annual Interest gross p.a.*. Monthly Interest gross p.a.* ; £1,+, %, %. Best fixed rate savings: Top accounts over one, two, three and five years in our tables. Fixed income investments, such as individual bonds or bond mutual funds, offer a way to diversify a portfolio. Explore fixed income funds as an investment. The investor decides to invest $20, into each of the three bonds. When the one-year bond matures, the $20, principal will be rolled into a bond maturing. The APY is the interest you can expect to earn on the money you keep in your account for one year. While this percentage may fluctuate depending on your bank. NatWest's Fixed Term Savings Account · What is a Fixed Term Savings Account? · Compare 1 year and 2 year Fixed Term Savings Accounts · Should I fix my savings rate. Based on current activity in the government bond market, fixed rates aren't likely to swing too hard one way or the other in the near future. But lenders are in.

Is A 401k Worth It

If you have a traditional (k) at work, the money you put into your (k) lowers how much you'll pay in taxes for the year and potentially puts you in a. On the other hand, if we contributed the same $ a month to our (k) for 30 years and earned an % rate of return, our end value might. As should be clear from the above, (k) plans are most definitely worth it if you can benefit from their advantages. If your employer offers a significant. If your employer has a (k) match program, they are essentially giving free money to help you build compound interest and grow your retirement savings faster. The Roth (k) allows you to contribute to your (k) account on an after-tax basis - and pay no taxes on qualifying distributions when the money is. (k) plans offer companies and employees tax advantaged investing accounts to save for retirement. Benefits include tax credits and tax deductions for the. Consider opening an IRA if your (k) doesn't match your contributions, charges high fees, and doesn't offer appealing investments. With a (k), an employee can control how his or her money will be invested. Many plans provide a spread of mutual funds with stocks, bonds, and money market. Employees anticipating a higher tax bracket after retiring might choose a Roth (k) to avoid paying taxes on their savings later. This decision could be. If you have a traditional (k) at work, the money you put into your (k) lowers how much you'll pay in taxes for the year and potentially puts you in a. On the other hand, if we contributed the same $ a month to our (k) for 30 years and earned an % rate of return, our end value might. As should be clear from the above, (k) plans are most definitely worth it if you can benefit from their advantages. If your employer offers a significant. If your employer has a (k) match program, they are essentially giving free money to help you build compound interest and grow your retirement savings faster. The Roth (k) allows you to contribute to your (k) account on an after-tax basis - and pay no taxes on qualifying distributions when the money is. (k) plans offer companies and employees tax advantaged investing accounts to save for retirement. Benefits include tax credits and tax deductions for the. Consider opening an IRA if your (k) doesn't match your contributions, charges high fees, and doesn't offer appealing investments. With a (k), an employee can control how his or her money will be invested. Many plans provide a spread of mutual funds with stocks, bonds, and money market. Employees anticipating a higher tax bracket after retiring might choose a Roth (k) to avoid paying taxes on their savings later. This decision could be.

Why contribute to a (k)? · Lower taxes: You get to invest money from your paycheck before taxes are taken out. · Automatic savings: Out of sight, out of mind. Many people decide if a (k) is worth it depending on whether their employer matches part of their contribution. Contributions to a (k) are made as pre-tax deductions during payroll, and the dividends, interest, and capital gains of the (k) all benefit from tax. In a (k) plan, your account balance will determine the amount of retirement income you will receive from the plan. While contributions to your account and. A traditional (k) can be one of your best tools for creating a secure retirement. It provides you with two important advantages. Contributing to both a (k) and an Individual Retirement Account (IRA) offers immense benefits: While (k)s often include a match from your employer. (k) amounts to a Roth (k). This is called Whether the mega backdoor Roth strategy is worth it in your situation can depend on a range of factors. It is a way to save for the future and it offers many investment options. The money that is put into a (k) is not subject to current income taxes. This means. There's a straightforward reason to max out your (k): The more you contribute, the greater potential for your retirement savings to accumulate. Let's look at. Not only do (k) plans have a higher contribution limit than other retirement plan options such as an IRA and SIMPLE IRA, but they're also flexible enough to. First, all contributions and earnings to your (k) are tax deferred. You only pay taxes on contributions and earnings when the money is withdrawn. Second. The answer is yes, it's always worth it. If they're doing a match, for every $ you contribute, they contribute $ That's a %. Yes, if you're 50 or older, you can make catch-up contributions to your k. This allows you to contribute more than the standard limit, helping you boost. 3 reasons to think twice before taking money out of your (k) · 1. You could face a high tax bill on early withdrawals · 2. You can be on the hook for a (k). Q: Is a (k) worth it with matching? A: Every employee must decide if participating in a (k) plan is worthwhile given that person's unique financial. With tax-free earnings and large contribution limits, Roth (k)s are worth considering. Learn about a Roth (k) vs. a traditional (k). Think of a (k) as a special savings jar where the money you put in isn't immediately taxed by the government. This means you can save more of your paycheck. (k)s are a good idea for nearly any employee who can participate, especially if a match is available. IRAs are great for anyone who doesn't have a retirement. Putting just 1% more into a tax-advantaged retirement account like a (k), (b), or an IRA could make a noticeable difference in your lifestyle in. Saving for retirement is a worthy endeavor and a financial task many people struggle with. Contributing the max to a (k) plan is not the best move if you.